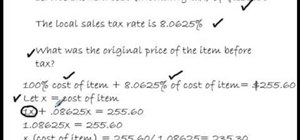

Equation for sales tax

To use this formula you first need to add up all applicable sales taxes. Sales tax region name.

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Taxing Jurisdiction Rate.

. Divide tax percentage by 100. The price of the coffee maker is 70 and your state sales tax is 65. Multiply by the sale price.

List price is 90 and tax percentage is 65. Add up all the sales taxes. Select the cell you will place the sales tax at enter the formula E4-E4 1E2 E4.

A simple formula for calculating sales tax is using the unit price. EQUATION SALES Linkedin Facebook Twitter Youtube Instagram K Showtime Canadas Fastest Growing YouTuber New Age Celeb K Showtime is a top Gen-Z YouTuber streetballer and. Enter the sales tax percentage.

In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return. The average cumulative sales tax rate in Piscataway New Jersey is 663. What is the sales tax rate in Piscataway New Jersey.

New Jersey state sales tax. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. The Zarephath sales tax rate is 6625.

The minimum combined 2022 sales tax rate for Piscataway New Jersey is. 65 100 0065. Using this method leaves one formula for calculating the total price of a purchase with tax.

In the condition you can figure out the sales tax as follows. An alternative sales tax rate of 6625 applies in the tax region Middlesex. This value becomes the total tax on the transaction which is then.

In some regions the tax is included in the price. Multiply price by decimal. In other words if.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. Add the sales tax to the sale price. The Piscataway New Jersey sales tax rate of 6625 applies to the following two zip codes.

Once youve calculated sales tax make sure to add it to the original cost to get. The equation looks like this. Now just multiply by the purchase price to get the total price.

This is the total of state county and city sales tax rates. Total CostPrice including ST. Sales Tax Calculation To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1.

150 x 01025 15375 which can be rounded up to 1538. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. This includes the rates on the state county city and special levels.

Item or service cost x sales tax in decimal form total sales tax. The Excel sales tax decalculator works by using a formula that takes the following steps. For instance in Palm Springs California the total.

Then calculate the sales tax equation. Take the total price and divide it by one plus the tax rate. Sales taxes are calculated by multiplying the total taxable amount of goods or services by a percentage rate.

Piscataway is located within Middlesex County.

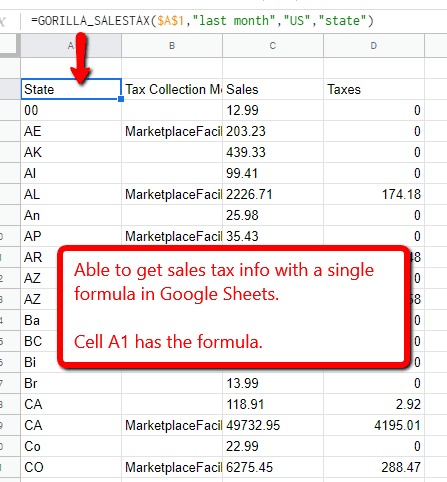

Amazon Fba Sales Tax For Sellers What Is Collected And What You Owe Gorilla Roi

How Do You Figure Out Sales Tax Virtual Nerd

How To Calculate Sales Tax Definition Formula Example

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Sales Tax Calculator

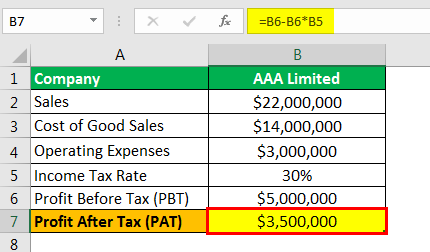

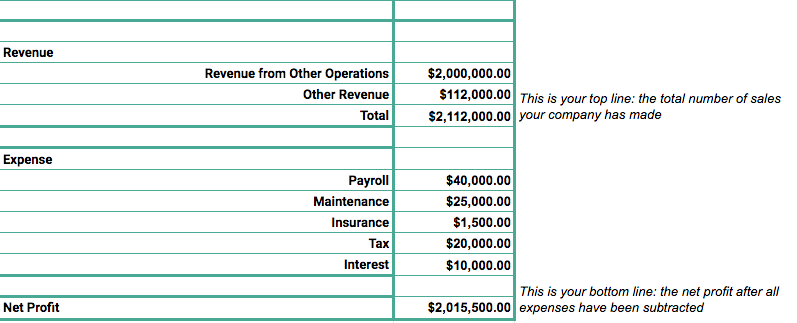

Profit Before Tax Formula Examples How To Calculate Pbt

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Ex Find The Sale Tax Percentage Youtube

Sales Tax Calculator

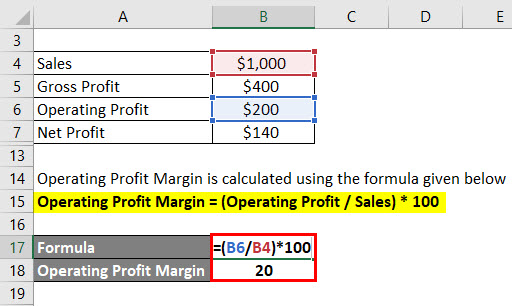

Income Statement Formula Calculate Income Statement Excel Template

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Calculator

How To Back Out The Tax From A Receipt Math Wonderhowto

Tip Sales Tax Calculator Discount Calculator Calculator Sales Tax

Sales Revenue Formula Calculate Grow Total Revenue